Tag Archive for: IRS

SST’s Top 5 Year-End Tax Strategies

The last quarter of the year can be a hectic time for many, so…

What You Need to Know About the IRS’ $80 Billion Spending Plan

The Inflation Reduction Act, which was enacted in August 2022,…

Inflation Reduction Act of 2022

On August 16, President Biden signed the budget reconciliation…

Determining the Right Form 990 For Your Organization

Most organizations believe that once they receive their exempted…

Payroll Pre-Tax Deductions – Section 125 Plan Documents

When it comes to attracting and retaining talent, most employees…

Taxpayer Notice: IRS Suspends Mailing of Additional Letters

In an effort to acknowledge their backlog of unopened mail and…

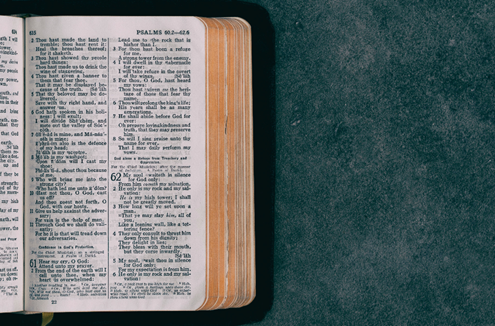

Religious Tax Benefits: Minster Housing Allowance

Please note: This blog is current to the date of its publication,…

Standard Mileage Rates Increase for 2022

Earlier this month, our team of seasoned tax experts shared a…

Top Four Tax Scams to Beware Of

In 2021, the Internal Revenue Service (IRS) published information…

2021 Tax Season: New Legislation Roundup

As we start off 2022, it’s important to be familiar with the…