Accounting for Employee Retention Credits

Employee Retetion Credits (ERCs) were established by the Coronavirus…

Cybersecurity Standards – Payment Card Industry Compliance

One of the most effective ways of maintaining trust with your…

Payroll Pre-Tax Deductions – Section 125 Plan Documents

When it comes to attracting and retaining talent, most employees…

Five Cybersecurity Tips from a Trusted SST Partner

Cybersecurity breaches are one of the largest threats to all…

Establishing a Procedure for Risk Assessment

Formal risk assessment procedures allow your organization to…

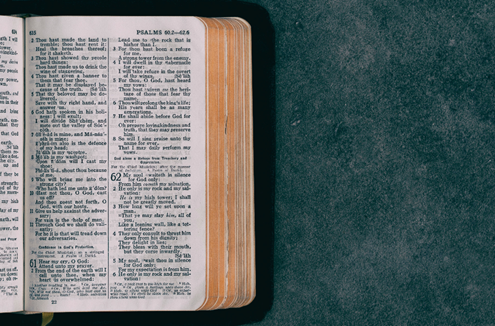

Religious Tax Benefits: Minster Housing Allowance

Please note: This blog is current to the date of its publication,…

Top Four Tax Scams to Beware Of

In 2021, the Internal Revenue Service (IRS) published information…

2021 Tax Season: New Legislation Roundup

As we start off 2022, it’s important to be familiar with the…

401(k) Nondiscrimination Testing: What is it, and how does it apply to your plan?

401(k) plans are meant to give employees the ability to save…

Nonprofit Donations: Common Challenges with Restricted Contributions

Updated February 2024

When a donor specifies their gift…