Understanding the U.S. Department of Education’s Composite Score Calculation

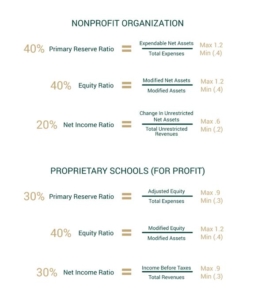

Institutions that are seeking to, or are actively participating in, Title IV funding administered by the U.S. Department of Education (ED) must meet a financial responsibility calculation called the Composite Score. The Composite Score, found at 34 CFR 668.172, is the result of three ratios: Primary Reserve, Equity, and Net Income. Obtaining a basic understanding of these ratios is critical for making the best decisions for your institution.

Below is a description of the ratios used:

Adjusted Equity = Total Equity – Intangible Assets – Unsecured Related-Party Receivables – Net Property Plant and Equipment + Post-Employment and Retirement Liabilities + Debt Obtained for Long-Term Purposes

Modified Equity = Total Equity – Intangible Assets – Unsecured Related-Party Receivables

Modified Assets = Total Assets – Intangible Assets – Unsecured Related-Party Receivables

In summary:

- 70% of the composite score is weighted on the balance sheet

- 30% is weighted on the income statement for proprietary schools

- 80% is weighted on the statement of financial position

- 20% is weighted on the statement of activities on unrestricted accounts for nonprofit institutions

Now that we have a better understanding of what goes into the composite score calculation, let’s address some common misconceptions:

- Our score was good last year. How can we be failing or in the zone this year?

While each situation is different, a passing composite score in the previous year could have been due to a strong net income ratio in the prior year that didn’t repeat in the current year and/or a combination of a decrease in adjusted or modified equity due to ownership distributions or cash purchases of fixed assets.

- But we have more cash or the same amount of cash at year end?

The amount of cash an institution has does not directly affect the composite score, as cash may be due to an increase in payables or unearned revenue. If an institution is experiencing increased enrollments, it’s likely going to experience an increase in unearned revenue, meaning more assets (like cash) must be retained just to have the same total equity. Therefore, you should consider monitoring Adjusted & Modified Equity instead of cash.

- But we had a good year/made income this year?

Net income only accounts for 30% of composite scores for proprietary institutions and only 20% for nonprofit institutions, so balance sheet ratios are likely the reason your composite score is under 1.5. One of the most common pitfalls we see is owners taking out more distributions than current year income which will decrease both balance sheet ratios.

What other questions do you have on calculating composite scores? SST’s team of higher education finance experts can help you find the answers for your institution. For a deep-dive consultation on your institution’s composite score, contacts us today to set up a consultation.